By: Saleem Khan, Chief Data & Analytics Officer – Pole Star Global

The US government’s plan to impose hefty port fees on Chinese shipping companies and Chinese-built vessels represents a major escalation in the ongoing trade war with China. The policy, unveiled by the Office of the US Trade Representative, has far-reaching implications for the global shipping industry. While this plan aims to penalise China’s maritime participation, its ripple effects will be felt across a range of industries, including US importers, exporters, and those with vested interests in international trade.

The Trump Administration’s Plan to Hit Chinese Ships with Port Fees

The initial proposal put forth by the Trump administration seeks to impose significant fees on Chinese ships entering US ports. The initial announcement set the stage for a system where vessels owned by Chinese carriers could face a $1.5 million fee per port call. Ships owned by non-Chinese carriers using vessels built in China could also incur a hefty fee of $1 million.

However, the Trump administration’s initial approach to these fees have had a revision. The fees are now largely based on vessel capacity rather than fixed charges per ship. This modification has resulted in a decrease in the fees for smaller vessels. Despite these revisions, the core objective of the plan remains unchanged: penalising Chinese shipping entities and restricting access to US ports unless they conform to specific trade policies.

Pole Star Global Data Insight: The Financial Implications of Port Fees

According to our analysis, in 2024, there were 14,295 port calls made by Chinese vessels to 252 US ports representing 18% of all port calls. The vessel types varied from containers to bulk carriers. Of these port calls, a total of 3,038 Chinese-owned or Chinese-built vessels visited US ports. If the proposed fees were enacted on April 17th and these same Chinese vessels were to visit US ports again this year, the proposed port fees for 2025 could amount to ~$17 billion. If they continue for a full year the number jumps to ~$23 billion.

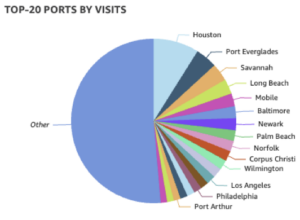

This number is staggering. To put this in context, a $23 billion increase in port fees represents a significant shift in the economics of global trade, especially for US companies engaged in import-export operations. It’s also a reflection of just how much influence Chinese vessels have in terms of US port visits. Chinese-owned ships accounted for a substantial portion of US port traffic, with Houston leading the charge in 2024. Houston alone saw 768 Chinese vessels visit its port 1,418 times – a staggering number. To put this in perspective, this is more than double the second-most visited US port by Chinese ships, Port Everglades.

Our data also reveals that the most frequently visited US ports by Chinese vessels include Houston, Port Everglades, Savannah, Long Beach, and Mobile. This information is not just useful for understanding past traffic patterns, but also critical for predicting future impacts and disruptions in the event of the new port fees being implemented.

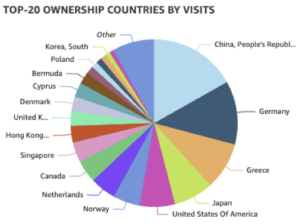

In terms of ownership, the top countries owning the largest fleet of ships visiting US ports are China, Germany, Greece, Japan, and the United States. This global ownership structure underscores the interconnectedness of the international shipping industry and the potential consequences of the new US policy on Chinese vessels.

A Complex Future for US-China Trade

The proposal to impose hefty port fees on Chinese vessels is a significant development in the US-China trade war, with far-reaching consequences for US importers, exporters, and global shipping companies. While the plan aims to exert pressure on Chinese shipping operations, it also creates new challenges for US businesses that rely on Chinese vessels for efficient, cost-effective shipping.

Our analysis provides critical insights into the scale and potential impact of these fees, highlighting just how much is at stake in terms of both economic cost and strategic positioning. With over $23 billion in potential port fees on the line, it’s clear that the impact of these fees will be felt across the entire trade ecosystem.

Navigating Global Trade with Superior Data Insights

At Pole Star Global, we specialise in providing unparalleled insights into global trade, including shipping trends, port activity, and vessel movements. Our data-driven approach allows businesses to make informed decisions, anticipate potential disruptions, and remain competitive in a rapidly evolving market.

We pride ourselves on providing detailed, actionable data on global trade. Through our comprehensive analysis, we can provide an accurate picture of how these proposed port fees could impact the shipping industry on both a national and international scale.