EU ETS shipping refers to the inclusion of the maritime sector in the European Union Emissions Trading System (EU ETS). As of 2024, shipping companies operating in the EU are required to monitor and pay for their CO₂ emissions through the purchase of emissions allowances, aiming to reduce greenhouse gas emissions from maritime transport.

The EU ETS is the world’s largest carbon market, which reduces greenhouse gas (GHG) emissions using a “cap-and-trade” method. As part of the EU’s plan to combat climate change, the EU ETS sets a limit on the total emissions allowed from major sectors like industry, power plants, and, more recently, shipping. In this system, companies can buy and sell permits to emit emissions, which encourages them to reduce their pollution.

EU ETS Key Statistics and Insights

Article Summary: The article explains the expansion of the European Union Emissions Trading System (EU ETS) to include the shipping sector from 2024. Under this scheme, shipping companies operating in EU waters are required to monitor and report their greenhouse gas emissions and purchase allowances (EUAs) to cover them. The system follows a cap-and-trade model, where a limit is set on total emissions, and companies can buy, sell or trade allowances to remain compliant.

This article outlines:

- How the EU ETS works, including monitoring, verification, reporting and surrendering allowances.

- Scope and coverage, such as 100% of emissions on EU–EU voyages, and 50% on EU–non-EU routes.

- A phased approach to implementation, starting with CO₂ in 2024 and adding methane (CH₄) and nitrous oxide (N₂O) from 2026, with rising percentages of emissions covered until full compliance in 2027.

- Compliance responsibilities, clarifying the roles of shipowners, ISM companies and charterers.

- Penalties for non-compliance, including financial fines, public naming and possible expulsion from EU ports.

- Practical guidance, with a seven-step plan for companies to open accounts, submit monitoring plans, record and verify emissions, surrender allowances, calculate return on investment (ROI) from emission reductions, and account for biofuels.

- Case study evidence showing how route optimisation can reduce both fuel costs and allowance expenses.

In short, the article introduces the EU ETS as a key climate policy tool, explains its new requirements for the maritime industry, and provides practical advice for shipping companies to comply and benefit from more efficient, low-carbon operations.

Key Statistics- Launch Year: 2005

- Scope: World’s largest carbon market

- Total Facilities Covered: 11,000+

- Coverage: ~45% of EU GHG emissions

- Countries Covered: EU Member States + Iceland, Liechtenstein, Norway

- Funds Raised: €175+ billion for climate-related investment

- Applies to Ships: ≥ 5,000 GT

- ETS Voyage Coverage:

- 100%: EU-to-EU port trips

- 50%: EU-to-non-EU or non-EU-to-EU port trips

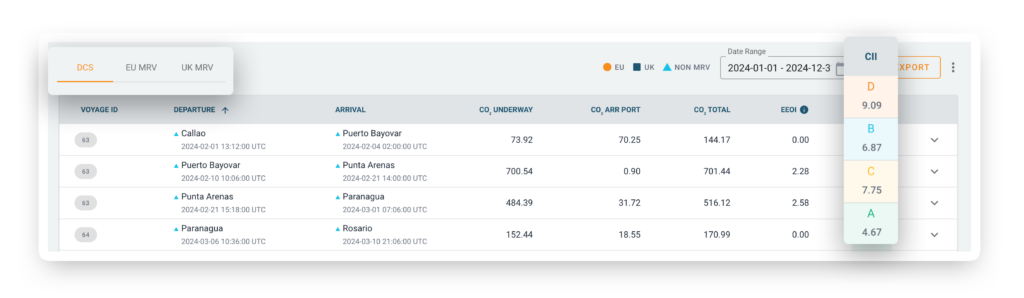

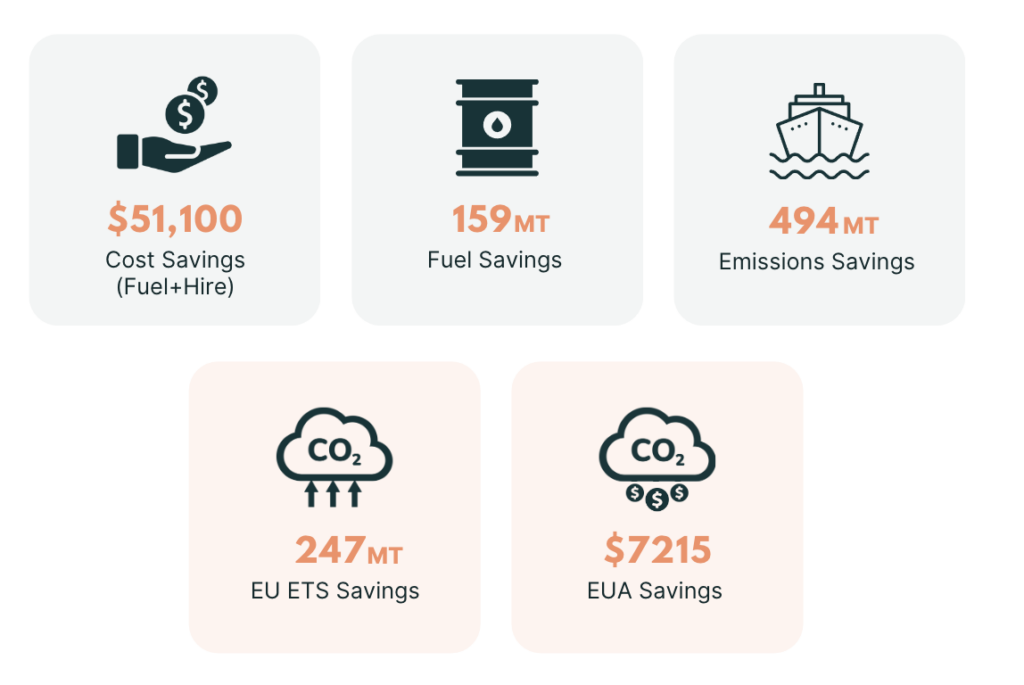

- ROI of Emission Reduction Efforts (Case Study)

- Aframax tanker using Podium5 route optimisation (Rotterdam → Tokyo via Suez)

- Fuel Efficiency Savings: ~$60,000 per voyage

- EUA Savings (at €70/EUA): €6,912.80 in 2025, and €17,278.50 in 2027

EU ETS as a Crucial Tool for Mitigating Climate Change

Since its launch in 2005, the EU ETS has become a crucial tool in fighting climate change. The system has generated over €175 billion to invest in renewable energy and low-carbon technologies. EU Member States indicate that emissions fell by 15.5% in 2023 compared to 2022. This brought emissions approximately 47% below 2005 levels. This positive trend highlights the EU’s significant progress toward its ambitious target of reducing emissions by 62% by 2030.

For the EU ETS to continue making an impact, all parties involved must adhere to regulations and collaborate to cut emissions. With that in mind, this article by Pole Star Global will detail how the EU ETS works. Specifically, this article considers the system’s recent expansion into the shipping industry.

By the end, you will understand the key elements of the EU ETS system, such as emission permits, monitoring, and compliance rules. Additionally, you will receive practical tips with a 7-step action plan to help you meet EU ETS requirements. Keep reading to learn how to navigate this system smoothly and stay ahead in reducing your carbon footprint.

- What is the EU ETS?

- How Does the EU ETS Work?

- EU ETS and Shipping

- EU ETS Shipping: A Phased Approach to Emission Reporting and Reduction

- How to Surrender Emissions For Shipping Under EU ETS and EUA (7-Step Guide)

- Who is Responsible For EU ETS Shippping Compliance? (Key Players)

- EU ETS Shipping: Your Questions Answered

What is the EU ETS?

The EU ETS is the world’s largest carbon market, operating under a dynamic “cap-and-trade” system. It sets a limit on the total greenhouse gas emissions (GHG) allowed for industries. Within that limit, companies have the flexibility to buy and sell emission rights, creating a marketplace for reducing carbon footprints.

Below is a quick snapshot of what the EU ETS encompasses for shipping:

- Covers about 45% of the EU’s greenhouse gas emissions.

- Operates in all EU countries, plus Iceland, Liechtenstein, and Norway.

- Controls emissions from more than 11,000 facilities.

Supporting the EU ETS, the EU-MRV system allows relevant entities to report carbon emissions following EU Regulation 2015/757.

| EU ETS Overview | |

| Sectoral Coverage |

|

| Revenue from the EU ETS will be used for |

|

| Emission Targets (European Climate Law) |

|

| Emissions Covered by EU MRV Maritime Regulation |

|

| Emissions Covered by the EU ETS |

|

How Does the EU ETS Work?

Key Terms:- EU ETS: Limits total greenhouse gas (GHG) emissions and allows companies to trade allowances within that cap.

- EUAs: Tradable permits that represent the right to emit one tonne of CO₂ equivalent (CO2e).

- Reporting: Companies monitor, verify, and report their emissions annually, surrendering the corresponding number of EUAs to remain compliant with the system.

- Cap: The EU sets a cap on the total amount of certain greenhouse gases (GHGs) that can be emitted. This cap is shared among companies within the sectors covered by the system. It is reduced annually to ensure that total emissions decrease over time.

- Allowances: Companies within the system receive or purchase emission allowances. One allowance permits the holder to emit one tonne of CO₂ or its equivalent in other GHGs.

- Trading: Companies can trade these allowances. If a company reduces its emissions below its allocated amount, it can sell the excess allowances to others. Companies that exceed their emissions limits must purchase additional allowances or face fines.

- Compliance: Each year, companies must surrender enough allowances to cover their emissions. If they fail to do so, they face heavy penalties.

EU ETS Reporting

Under the EU Emissions Trading System (ETS), companies must keep track of their emissions and report this data to ensure they are following the rules.

- Monitoring: Companies must measure and monitor their CO₂ and other GHG emissions according to detailed rules set by the EU. This typically involves using measurement tools and tracking systems to ensure accuracy.

- Verification: A third-party verifier will check emission reports to confirm they are accurate and meet EU standards.

- Reporting: Companies must submit their verified emissions data to national authorities annually. The report is due by the end of March each year for the previous year’s emissions.

- Surrendering Allowances: After submitting the emissions report, companies must surrender the equivalent number of EUAs by the end of April each year.

EU ETS and Shipping

Starting in January 2024, the EU’s Emissions Trading System (EU ETS) will include CO₂ emissions from:

- All large ships weighing 5,000 gross tonnes or more;

- Vessels that enter EU ports, regardless of the country in which they are registered.

Under the EU ETS:

- 100% of emissions are accounted for from ships that leave a port in an EU country and arrive at another port in an EU country.

- 100% of emissions from ships operating within a port in an EU country are also included, which covers emissions released while the ship is docked and while it is moving around the port. (Emissions occurring during a ship’s entry or exit before it docks are part of the entire journey and are not counted as port emissions). When recording emissions at the port, it’s crucial to distinguish between emissions at berth and emissions within the port.

- At berth refer to those produced while a ship is securely docked or anchored in an EU port, including emissions from loading and unloading cargo, as well as any time spent in the port, even if the ship isn’t actively working.

- Within the port include all emissions in an EU port of call, counting both docked emissions and those from the ship moving around the port. However, emissions from movement within the port should only be counted if they are not already included in the ship’s overall journey.

- 50% of emissions from ships that leave a port in an EU country and arrive at a port in a non-EU country are also managed.

- 50% of emissions from ships that leave a non-EU port and arrive at a port in an EU country (for example, from Shanghai to Rotterdam) are accounted for.

EU ETS Shipping: A Phased Approach to Emission Reporting and Reduction

The EU ETS system tracks CO₂ emissions, and starting in 2026, this system will also track CH₄ (methane) and N₂O (nitrous oxide) emissions. Each tonne of CO₂ emissions counts toward the total cap set by the EU ETS, which will decrease over time (see the table below). This aims to encourage energy efficiency and make alternative shipping fuels cheaper compared to traditional fuels.

A Phased Approach to EU ETS Implementation for Shipping

| Data | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 Onwards |

|---|---|---|---|---|---|---|

| Ship Sizes and Type | ||||||

| Cargo/passenger (5000+ GT) | ||||||

| Offshore Ships (5,000+ GT) | ||||||

| Offshore and general cargo ships (400–5,000 GT) | To Be Decided |

|||||

| Greenhouse Gases | ||||||

| Carbon Dioxide (CO₂) | ||||||

| Methane (CH₄) | ||||||

| Nitrous Oxide (N₂O) | ||||||

| Phase In | ||||||

| % of Emissions Included in ETS Scope | 40% | 70% | 100% | 100% | 100% | |

Reporting Only

Included in ETS Scope

Souce: Information Obtained From EU ETS – Emissions Trading System by DNV (Det Norske Veritas)

The first deadline to surrender allowances will be in September 2025 for emissions reported from January 1 to December 31, 2024. Authorities in EU member states will ensure compliance with EU ETS regulations.

Regarding ships, EU ETS guidelines apply only to cargo and passenger ships of 5,000+ gross tonnes (GT). However, the system will gradually expand to incorporate more vessels, as shown in the table above.

Authorities approved the EU ETS rules on May 16, 2023, and put them into effect on June 5, 2023.

There will also be a system in place to monitor how these rules are working in the shipping industry and to consider any new developments from the International Maritime Organization (IMO).

How to Surrender Emissions For Shipping Under EU ETS and EUA (7-Step Guide)

Navigating the new EU ETS regulations can present challenges for shipping companies. To simplify this process, Pole Star Global has developed an easy-to-follow, step-by-step guide designed to assist stakeholders in getting started. Follow the steps below to learn how to properly surrender your emissions under the EU ETS.

Step #1: Open a Maritime Operator Holding Account

The Union Registry is a central database that keeps track of emissions allowances within the EU Emissions Trading System (ETS). It logs all transactions related to these allowances and ensures that companies meet their emission reduction goals. For shipping companies to participate, they must open an account in the Union Registry by submitting a request to the national administrator, who will collect and verify all the required documents.

The Union Registry includes a special account called the Maritime Operator Holding Account, which shipping companies use to manage their emissions allowances. Companies buy, sell, and surrender EUAs through this account.

To register this account, companies need to work with the national administrator in their EU Member State. The EU ETS provides a list of Administrative Authorities for EU ETS Maritime to help companies with compliance.

According to the updated Registry Regulation, shipping companies must provide information to their national administrator to open a Maritime Operator Holding Account:

- Within 40 working days after the attribution list is published (on January 31, 2024). The attribution list shows which shipping companies or vessels must follow ETS rules.

- For shipping companies not on the list, within 65 working days after their first stop at a port covered by the ETS Directive.

Step #2: Submit Your Monitoring Plan

A monitoring plan is an important document that explains how a company will track and report its greenhouse gas (GHG) emissions over a certain period.

For Shipping Companies:

- Each company must submit a monitoring plan for every ship covered by the MRV Maritime Regulation and the ETS Directive. This submission is due by April 1, 2024.

- If a ship is included under these regulations for the first time after January 1, 2024, the company must submit the monitoring plan within three months of the ship’s first port of call in an EU Member State.

Submitting the Monitoring Plan:

- Submit all new monitoring plans through THETIS-MRV.

- An independent, accredited verifier must check and approve the plans before submissio to ensure compliance with the MRV Maritime Regulation.

Important Tip:

- When preparing your monitoring plan, make sure to stay flexible and include any recent changes to the MRV Maritime Regulation.

For More Information:

- Check out Guidance Document No. 2 for details on the approval process from administering authorities.

Step #3: Record Emissions

To surrender allowances successfully, companies need to report their ship emissions accurately. Emissions should be monitored according to the revised monitoring plan.

Using advanced onboard emission tracking technology, such as Pole Star Global’s cutting-edge Podium5 interface, greatly simplifies this process. With Podium5’s Emissions Module, emission data is captured and reported in near real-time. The data is then stored on a centralised platform, allowing all stakeholders to easily access, review, and analyse the information they need.

The goal at Pole Star Global is to automate and streamline the process of recording greenhouse gas (GHG) emissions, ensuring that it aligns seamlessly with EU ETS regulations. This approach helps users navigate the complexities of compliance.

Step #4. Report Emissions and Get Them Verified

Every year, shipping companies are required to submit two types of emissions reports: one for each ship they operate and another that combines all emissions data at the company level. An accredited verifier must verify all reports—both for individual ships and the company as a whole by March 31 of the following year. If the administering authority requests it, companies must meet the deadline by February 28.

Verifiers approved by EU Member States (known as National Accreditation Bodies) will check ships’ emissions. Shipping companies can choose any accredited verifier for their ships, regardless of the flag the ship flies or the locations of the company and the verifier. This means a company can have different verifiers for each of its ships and can also use different verifiers to check the emissions report of the ship and the company as a whole.

Since 2018, shipping companies have been following the MRV Regulation and must report their emissions data through THETIS-MRV. Under EU ETS, this process remains the same.

The European Maritime Safety Agency (EMSA) manages the EU-MRV platform.

For more details, refer to Guidance Document No. 1 (The EU ETS and MRV Maritime General Guidance for Shipping Companies), especially Section 4.1.1.2.

Important Note: The entity responsible for meeting ETS obligations must also comply with MRV obligations. With Pole Star Global’s Podium5 Emissions Module, emissions data is reported in compliance with UK MRV.

Step #5. Surrender EUAs

Shipping companies must purchase general EU allowances (EUAs), which are the same type used across all industries under the EU ETS. To comply with regulations, such companies must surrender their allowances in the EU Member State where their administering authority is located. Shipping companies carry out this process through the Maritime Operator Holding Account, Maritime Operator Holding Account set up in Step #1.

Companies can acquire emission allowances through auctions held on the European Energy Exchange (EEX), which is managed by the EU and its Member States. (There is also a secondary market where allowances can be traded between parties or through various financial instruments.)

To buy ETS allowances, companies need to open either a trading account or a Maritime Operator Holding Account in the Union Registry (see Step #1). It is worth mentioning that opening a trading account is optional. Non-EU citizens can also request to open a trading account with the national administrator if they meet the requirements.

EU allowances (EUAs) issued from 2013 onward do not expire and can be saved for future use. However, once a company surrenders an allowance, it cannot retrieve it.

Each allowance represents the company’s right to emit a specific amount of greenhouse gases (1 EUA = 1 tonne of CO₂ or its equivalent).

Following the phased surrender approach:

- 2025: Companies must surrender allowances for 40% of their recorded emissions for the year 2024.

- 2026: Companies must surrender allowances for 70% of their recorded emissions for the year 2025.

- 2027 and onward: Companies must surrender allowances for 100% of their recorded emissions starting in 2026.

How to Surrender EUAs: Example

For example, if your company emits the following amounts:

- 2024:10,000 tonnes of CO₂

- 2025: 12,000 tonnes of CO₂

- 2026:15,000 tonnes of CO₂

The phased surrender would be as follows:

- 2025 (for 2024 emissions):

- Emissions in 2024: 10,000 tonnes of CO₂

- Required surrender in 2025: 40% of 10,000 tonnes = 4,000 allowances (EUAs)

- 2026 (for 2025 emissions):

- Emissions in 2025: 12,000 tonnes of CO₂

- Required surrender in 2026: 70% of 12,000 tonnes = 8,400 allowances (EUAs)

- 2027 (for 2026 emissions):

- Emissions in 2026: 15,000 tonnes of CO₂

- Required surrender in 2027: 100% of 15,000 tonnes = 15,000 allowances (EUAs)

Important Note: If you use carbon credit certificates to offset emissions, this will not affect the number of allowances you need to surrender, and they cannot be used for compliance with the EU ETS. You must surrender EUAs corresponding to the total emissions data reported at the company level under the EU ETS Directive.

Step #6. Estimate the ROI of Any Emission Reduction Efforts (Case Study Example)

The EU ETS scheme aims to create a competitive market that reduces the costs of green investments and fuels. By investing in technology that decreases your organisation’s dependence on fossil fuels – whether through efficiency improvements or a switch to alternative green fuels – you can gain a significant competitive edge in this new landscape.

To assess the return on investment (ROI) for efforts to reduce greenhouse gas (GHG) emissions, refer to the calculations in Step #5. Next, consider the following process, which outlines how to accurately calculate the ROI of such initiatives.

Calculating the ROI of Emission Reduction Efforts Under EU ETS: Case Study Example

One client utilising Pole Star Global’s Podium platform saved approximately$60,000 by optimising their voyages for greater efficiency.

In this case study, an Aframax tanker took a more efficient route from Rotterdam (EU) to Tokyo (non-EU) via the Suez Canal. By utilising Podium5’s route optimisation capabilities, the tanker was able to identify the most efficient route, factoring in weather and current conditions. The goal was to consume less fuel and, consequently, reduce GHG emissions. However, the reported savings of $60,000 do not fully capture the ROI in the context of the current EU ETS environment.

To accurately estimate the ROI of this emissions reduction initiative, you need to factor in the EUAs over time, which change as follows: 40% in 2024, 70% in 2026, and 100% in 2027. Total emissions for the optimised voyage are recorded and compared to estimated emissions from the traditional route. EUAs are then applied to determine the true savings.

Since this journey was between an EU port and a non-EU port, 50% of the voyage emissions need to be accounted for under the EU ETS. With all of this in mind, here’s how the savings break down, applying data from the Podium platform.

- In 2025, with 40% ETS coverage, the savings would amount to 98.74 EUAs, equating to €6,912.80 per voyage for €70 per EUA.

- In 2026, with 70% coverage, the savings rose to 172.76 EUAs, valued at €12,093.20 per voyage.

- In 2027, with 100% coverage, the savings reached 246.85 EUAs, worth €17,278.50 per voyage.

As illustrated, the ROI for investments aimed at reducing GHG emissions will increase over time.

How to Automate ROI Calculations for Emission Reduction Initiatives Under the EU ETS

However, it’s crucial to remember that these calculations can become quite complicated and are often susceptible to human error. With Pole Star Global’s Podium5, you can save time and reduce errors by automating this complexity. This allows you to obtain precise ROI assessments, empowering you to make informed investment decisions with confidence.

Step #7. Accurately Account for Emissions From Biofuels

When companies burn biomass that meets certain sustainability standards, it counts as having zero carbon dioxide (CO₂) emissions under the ETS. The ETS also allows some other renewable fuels, regulated by the Renewable Energy Directive (RED), stated to have zero emissions, such as Renewable Fuel Biomass Origin (RFBOs) and Recycled Carbon Fuels (RCFs). Note that alternative fuels must save a certain amount of greenhouse gases (GHGs) compared to regular fossil fuels to qualify for this zero emission rating.

The EU ETS Directive has also specified rules regarding Carbon Capture and Utilisation or Storage (CCU/S) technologies. Companies do not have to surrender allowances for:

- CO₂ that is captured and sent to a site for storage according to the Carbon Capture and Utilisation or Storage (CCU/S) Directive.

- CO₂ used to create a product that is permanently locked away, preventing it from entering the atmosphere.

(There are specific conditions for the above, as detailed under the Emissions Trading System (ETS) – Permanent Emissions Storage Through Carbon Capture and Utilisation).

Who is Responsible For EU ETS Shipping Compliance? (Key Players)

The person or organisation responsible for a ship’s emissions can be either the shipowner (the registered owner) or the ISM Company of that ship. The registered owner and the ISM Company need to decide who should handle the responsibilities for complying with the ETS and MRV rules. If they don’t make a clear decision, the registered owner will be considered responsible by default.

If the registered owner decides to take responsibility for the ETS and MRV rules, they must provide the administering authority with a document listing the ship(s) for which they are responsible. If the ISM Company agrees to take responsibility for the ETS and MRV rules for one or more ships, it must provide the administering authority with a document that shows the registered owner has authorised it to comply with these obligations. If it does not provide such a document, the administering authority considers the registered owner responsible by default.

When it comes to surrendering allowances, the shipping company always remains responsible for this. However, if the shipping company has to surrender (or pay for) emission allowances while another entity is responsible for fuel and operations, the shipping company is entitled to be reimbursed by that entity.

Can a Bareboat Charterer be the Regulated Entity for MRV and ETS Compliance Purposes?

A bareboat charterer can be responsible for following the ETS and MRV rules for a ship only if they have agreed to take on the responsibilities of the ISM Code for that ship. In this case, the ISM Company must provide proof of this agreement to their administering authority.

However, even if a bareboat charterer takes on these responsibilities, they are not considered the actual owner of the ship under the ETS and MRV rules. This means they don’t have all the rights and responsibilities that come with ownership. For instance, a bareboat charterer can only open a Maritime Operator Holding Account if the shipping company has authorised them to do so.

Regardless of who opens the account or takes on tasks, the Maritime Operator Holding Account must be in the name of the shipping company (the registered owner or the ISM Company). This is important because it emphasises (as mentioned above) that the shipping company is ultimately responsible for managing and surrendering emissions allowances.

EU ETS Shipping: Your Questions Answered

For more information, head to FAQ – Maritime transport in EU Emissions Trading System (ETS).

What Counts as a Port Under EU ETS?

A port of call refers to the place where a ship stops to load or unload cargo, and allow passengers on or off, or where an offshore ship stops to give the crew a break. The following does not count as a port of call, when a ship stops to:

- Refuel.

- Get supplies.

- Give the crew a break (except for offshore ships).

- For repairs or maintenance of the ship or its equipment.

- For help/assistance.

- Make a transfer between ships outside of ports.

- Avoid bad weather or due to search and rescue efforts.

- Work with container ships at nearby ports that are specifically listed in related regulations.

What Do I Do When a Trip Takes Place During Two Reporting Periods?

A reporting period runs from January 1 to December 31 of a year. If a voyage starts in one year and ends in another, emissions data must be recorded separately for each year. For example, emissions tracked until December 31, 2024, will be included in the 2024 report. Then, emissions from the part of the voyage that occurs on or after January 1, 2025, will be reported in the 2025 emissions report.

How Will EU ETS Requirements Be Enforced?

Each EU Member State is responsible for ensuring that all shipping companies within its borders meet their obligations under the EU ETS. This includes ensuring that these companies submit enough allowances on time. The Union Registry will provide information about whether these companies are complying, and the relevant authorities will have access to it.

If a shipping company fails to surrender the required allowances, it will face a penalty of €100 (adjusted for inflation) for each tonne of CO₂ equivalent it should have surrendered. The company must still submit the required allowances, and authorities will make its name public as part of the penalties.

When a company does not comply with two or more reporting periods, and other attempts to enforce compliance have failed, the relevant authority in the Member State where the ship enters can issue an expulsion order. This means all EU countries must refuse entry to that company’s ships until it meets its obligations. If a ship flying the flag of an EU country enters one of its ports, that country can detain the ship until the company fulfils its obligations, but it must first give the company a chance to respond.

Who Will Ensure Compliance with ETS Rules?

Each EU Member State is responsible for ensuring that all shipping companies within its borders meet their obligations under the EU ETS. This includes ensuring that these companies submit enough allowances on time. Information about compliance will come from the Union Registry and will be available to the relevant authorities.

Are There Special Rules for Ships Travelling to Outermost Regions?

Yes. Until December 31, 2030, shipping companies do not have to surrender allowances for emissions from trips between an outermost region of an EU Member State and the mainland, or between ports in the same outermost region.

Are There Special Rules for Ships on Routes with a Public Service Obligation (PSO) or Contract (PSC)?

Yes. If two EU countries have a PSO or PSC, and one of the countries doesn’t share a land border with another EU country, shipping companies do not have to surrender allowances for emissions from passenger ships or ferries on those routes until December 31, 2030. You can find a list of PSO route here.

What if a Shipping Company Only Runs Routes that are Exempt from the ETS? Do They Still Need to Report Emissions?

Yes. Even if a shipping company’s routes are fully exempt, they still need to monitor and report their emissions as required by the ETS Directive and EU MRV Maritime Regulation. The exemptions only mean they don’t have to surrender allowances.

How are Emissions at Ports for Voyages with ETS Exemptions Counted?

If a ship is on a voyage with an ETS exemption, its emissions while at the port are also exempt from needing allowances.

What About Nearby Container Transshipment Ports Within 300 Nautical Miles?

To prevent companies from using nearby ports to avoid the ETS, there is a rule for “ neighbouring container transshipment ports.” Stops at these ports do not count as the start or end of a voyage under the ETS. The European Commission has identified Tanger Med (Morocco) and East Port Said (Egypt) as such ports in a regulation adopted on October 26, 2023. This list will be updated every two years.

EU ETS 2023 Reform: Key Changes

New 2030 Goals and Rules for EU ETS:

- Emissions Reduction Goal: The new target for reducing emissions under the EU ETS by 2030 is 62% lower than 2005 levels, an increase from the previous target of 43%. Additionally, the “Fit for 55” package has been introduced to align the system with the EU’s 2030 climate target of at least 55% net emissions reductions compared to 1990 levels and the objectives of the European Green Deal.

- Reduction Rate: The plan is to cut emissions by 4.3% each year from 2024 to 2027 and by 4.4% each year from 2028 to 2030.

- Use of Revenue: EU member countries must spend all money earned from emissions trading on climate-related projects.

- Shipping Emissions: Starting in 2024, emissions from ships will be included in the EU ETS.

- Free Emission Allowances: The free emission allowances for certain products, like cement and steel, will gradually end by 2034. Starting in 2026, companies that receive free allowances must invest in improving energy efficiency and reducing emissions.

- Market Stability Reserve Changes: 24% of all ETS allowances will remain in the market stability reserve. This reserve helps manage the surplus of allowances and allows the EU ETS to adjust more easily to changes in supply and demand.