How is the Red Sea Crisis impacting the Suez Canal? Escalating conflicts in the Middle East overshadow maritime trade, with a pronounced impact on the Suez Canal. In response, vessels are choosing the lengthier route via the Cape of Good Hope. This strategic shift reverberates across vital industries, causing disruptions in maritime trade while exacerbating rising shipping costs and inflation rates. This paints a complex and challenging scenario for global supply chains.

Since November 19th, the Red Sea has become a hotspot of escalating conflict fueled by the militant faction, the Houthi Yemen. The reverberations of this turmoil have sent shockwaves through global supply chains. In response, ships reroute to bypass the Red Sea, diverting away from the Suez Canal and opting instead for the longer path via the Cape of Good Hope. The enduring effects of this crisis on import and export trade, key industries, and the cost of shipping and inflation rates remain uncertain. Such impacts are contingent upon the escalation of this conflict within the Middle East.

Against this backdrop, Iran’s recent assaults on Israel have further unsettled the maritime industry, highlighting increased risks on the horizon.

In response, Pole Star Global remains steadfast in monitoring the situation. Comprehensive insights are provided detailing how these events will impact the maritime sector, particularly concerning the Suez Canal and the Red Sea.

This analysis delves into the significance of the Suez Canal as a critical trade route, drawing on past disruptions to anticipate the future consequences of its current impracticality. As vessels divert away from this vital artery, the repercussions are evaluated. Particularly, impacts on key industries, notably the energy sector, import and export trade, and global shipping costs, as well as inflation rates, are considered. Moreover, actionable insights are provided to help you navigate the contractual challenges arising from the Middle East conflict and the ongoing Suez Canal crisis.

- What is Happening in the Red Sea?

- Suez Canal Importance as a Key Trade Route

- Can We Learn From the Past to Predict the Future?

- Will the Conflict Within the Middle East Spark a Shipping Crisis amid the Suez Canal’s Infeasibility?

- How to Manage Contractual Challenges of the “Red Sea Crisis” for Maritime Security

- Activate Essential Watchlists Within Pole Star Global for Compliance and Safety at This Critical Time

What is Happening in the Red Sea?

The Yemen Houthis are a militant faction that exerts control over significant territories within Yemen. Backed by Iran, this group views Israel as their adversary. In response to the Gaza Strip conflict, the Houthis launched drone and missile strikes towards Israel. While most have been intercepted, tensions remain high.

On November 19, 2023, these tensions escalated when the Houthis captured a commercial vessel, the Galaxy Leader, in the Red Sea. The Galaxy Leader is a British-owned and Japanese-operated cargo ship. At the time of its interception, the vessel was en route from Europe to India with no cargo. (See the image below, obtained from Pole Star Global’s Maritime Domain Awareness (MDA) platform). The Houthis declared their intention to target any ships associated with Israel that pass through these waters. Pole Star Global continues to provide essential visibility over such shipments.

The Galaxy Leader Was Captured by the Houthi Militant Group en Route From Europe to India via the Suez Canal

Image obtained from Pole Star Global’s Maritime Domain Awareness (MDA) platform.

Since then, the Houthis have struck 29 more ships, with 13 suffering direct hits from missiles and drones. The repercussions are felt far and wide, with industry giants like Maersk and Hapag-Lloyd rerouting vessels away from the southern Red Sea and the Suez Canal, opting for the safer but longer passage around the Cape of Good Hope. In fact, since December 15th, four of the world’s five largest container-shipping companies -CMA CGM, Hapag-Lloyd, Maersk, and MSC – have paused or suspended their services in this region.

In response to this turmoil, the United States has led a multinational military endeavour named Operation Prosperity Guardian. A coalition of forces is involved, which includes major exporters such as Germany, South Korea, the United Kingdom, and Denmark. The aim is to stem Houthi assaults on merchant ships, particularly safeguarding those navigating the Bab-el-Mandeb strait between the Arabian Peninsula and the Horn of Africa.

Suez Canal Importance as a Key Trade Route

The Suez Canal plays a crucial role in global supply chains, handling approximately 12% of all trade and 30% of container traffic worldwide.

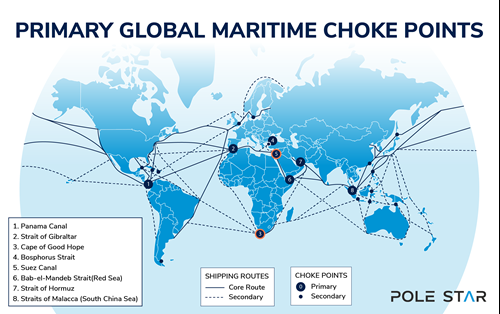

The Suez Canal stands as a vital conduit along major shipping routes, offering a direct link between the North Atlantic and Northern Indian Oceans via the Mediterranean Sea and the Red Sea. Positioned as one of several maritime choke points, disruptions at such strategic sites can have far-reaching effects on maritime trade. Identifying feasible alternative routes in such scenarios can be challenging, if not entirely unattainable. The consequences of this were starkly illustrated by the 2021 Suez blockage (see below).

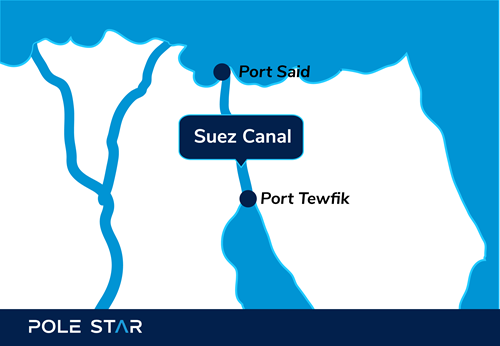

Suez Canal Map

- The Suez Canal divides Africa from Asia and the Sinai Peninsula from the rest of Egypt.

- Beginning in Port Said, the Suez Canal extends to its southern terminus at Port Tewfik, located in the city of Suez.

The Suez Canal Begins in Port Said and Extends to its Southern Terminus at Port Tewfik

The Suez Canal plays a pivotal role as a trade route between Europe and Asia, without which vessels would have to take a longer route around Africa (via the Cape of Good Hope). For instance, the Suez Canal shortens the journey distance from the Arabian Sea to London by approximately 8,851 km (5,500 miles). For every round trip between Asia and Europe, this is expected to cost up to $1 million in extra fuel and add approximately 14-25 days to voyage time.

The Suez Canal Offers Vessels a Direct Route Between the North Atlantic and Northern Indian Oceans via the Mediterranean Sea and the Red Sea

Can We Learn From the Past to Predict the Future?

The 1956 Suez Canal Crisis

The Suez Canal Authority (SCA) is an Egyptian state-owned entity tasked with the ownership, operation, and maintenance of the Suez Canal. Prior to July 1956, the concessionary company overseeing it was predominantly owned by British and French shareholders. However, in 1956, Egypt’s President Gamal Abdel Nasser nationalised the canal, transferring control to Egypt’s state-owned authority, the Suez Canal Authority. Since then, this authority has retained responsibility for the canal’s operations and upkeep.

In response to Nasser’s decision, the UK, France, and Israel attempted to regain control through military action. However, pressure from the international community, particularly the United States and the Soviet Union, compelled these nations to withdraw their forces. This conflict resulted in the closure of the Suez Canal from November 1956 to April 1957. At the time, two-thirds of European oil imports relied on the canal, meaning this closure significantly disrupted maritime trade. This underscored the canal’s pivotal role in supporting global supply chains and the world economy.

Since 1956, the significance of global supply chains has increased. Consequently, disruptions in the Red Sea are expected to have a greater impact. By examining more recent events, it’s possible to formulate more accurate predictions regarding the implications of shipping attacks in the Red Sea on maritime trade.

The 2021 Suez Canal Blockage

On March 23, 2021, the Suez Canal was blocked by a massive container ship – the Ever Given. This vessel ran aground, obstructing passage for over 400 vessels scheduled to traverse the canal in both East-West and West-East directions. The blockage resulted in supply chain disruptions costing $15 to $17 billion, with over 100 ships accumulating at each end of the canal.

Key Takeaways: These two historical incidents underscore the significance of the Suez Canal in facilitating smooth maritime trade and sustaining the global economy. By reflecting on these events, we can anticipate the repercussions of current disruptions.

Will the Conflict Within the Middle East Spark a Shipping Crisis Amid the Suez Canal’s Infeasibility?

Following Iran’s attack on Israel, conflicts within the Middle East continue to escalate. The repercussions will be felt globally, particularly regarding:

- The energy sector.

- Global maritime trade.

- The cost of shipping, and consequently, global inflation rates.

The Energy Sector Is Particularly Vulnerable to Any Escalation of the Conflict Within the Middle East

“In the case of the conflict in Israel, any expansion of the hostilities beyond the country’s borders could introduce risks to two vital shipping choke points. The Suez Canal, a critical waterway for various commercial vessels, including container ships, may face disruptions. Similarly, the Strait of Hormuz, a backbone for oil and gas shipping, could also be affected. However, the extent of these effects will largely depend on the conflict’s expansion and duration” – Christin Reoloffs, Founder and CEO of xChange

Diplomatic efforts have focused on containing the fallout from the October 7th attack on Israel by the Palestinian militant group Hamas. Any possible escalation in this conflict poses a major threat to the global economy by driving up energy prices and disrupting key trade routes. Yet, preliminary signs of economic upheaval have already emerged, with the October 7th attack causing a temporary spike in oil prices. These prices have since moderated slightly; however, the situation remains unstable.

There’s a risk that the conflict could escalate further into a long and drawn-out war. This could lead to the closure of the Suez Canal and cause oil prices to rise to nearly $100 per barrel, and European TTF to reach $80.

“Any expansion of the war into the Sinai Peninsula and Suez region increases the risks of an attack on energy and non-energy trade flowing through the Suez Canal, and that accounts for almost 15% of global trade, almost 45% of crude oil, 9% of refined, and also 8% of LNG tankers transit through that route,” – The Economist Intellectual Unit (EIU), Pat Thaker

Moreover, this conflict comes at a time already marked by financial instability. Factors causing this instability include the war in Ukraine and central banks approaching a critical point in their monetary cycles. For instance, oil prices hit $140 per barrel after Russia invaded Ukraine last year.

At present, the Red Sea crisis has resulted in the accumulation of 100 million barrels of oil in international waters, as shipping companies reroute flows to evade attacks by Houthi militants. This, along with Russian shipping fractions, has hiked crude prices by $4 per barrel.

The Impact of Middle East Conflict on Global Maritime Trade

Cautionary advisories have been issued for international operations. Beyond this, it’s too early to know how the conflict will impact global supply chains. For instance, major players give reassurance that operations across Israel’s key port terminals are functioning as normal. This includes container logistics and supply chain provider Maersk. This sentiment was echoed by the global shipping company MSC.

However, Israel’s energy ministry instructed Chevron, the second-largest U.S. oil and gas producer, to cease operations at the Tamar natural gas field off the northern coast of the country. Adani Ports, the operator of Haifa Port, has reassured stakeholders of the company’s preparedness and actively monitors the situation with a business continuity plan in effect.

“A crackdown on Iranian oil exports could immediately remove somewhere from 1-2 mbd (million barrels per day) off the market almost instantly” – Brent Belote, CIO and founder of Cayler Capital

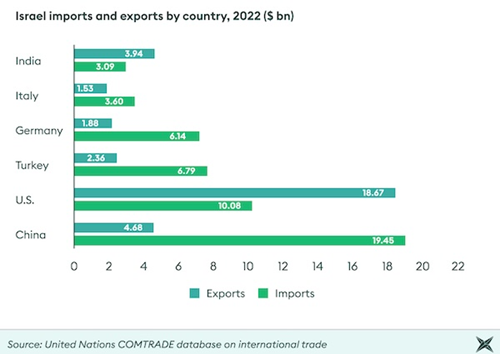

Israel is a critical trade partner for key international regions. This includes economically influential superpowers such as India and China. The chart below details the monetary value of imports and exports between Israel and its core trade partners for 2022 (information obtained from the United Nations COMTRADE database on International Trade). Those travelling through the Suez Canal include imports and exports between Israel and China, and Israel and India.

- India: India is a crucial trade partner for Israel. The country imports $3.94 billion worth of Israel’s exports, while Israel imports $3.09 billion worth of goods from India.

- China: Israel imports a massive $19.45 billion worth of goods from China and exports $4.68 billion worth of goods.

Image obtained from United Nations COMTRADE database on International Trade.

Yet, it must be noted that the above data refers to trade with Israel only. Most ships that use the Suez Canal are on voyages between European and Asian ports – as this is the only feasible route between these ports. For instance, more than 60% of Chinese goods are shipped to Europe via the Suez Canal.

The canal’s throughput dropped dramatically from 500,000 per day in November 2023 to 200,000 per day in December 2023, marking a 40% decline. This was followed by an additional 64% reduction in throughput for 2024.

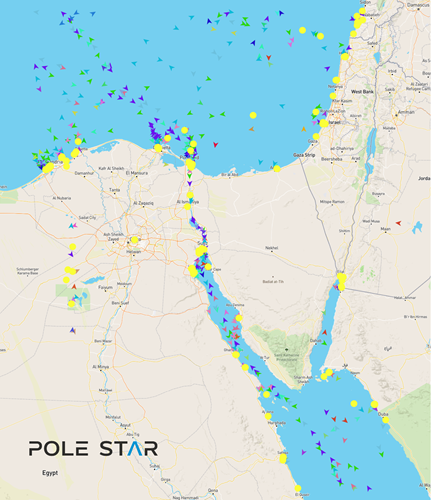

Recent data acquired by Pole Star Global shows that declines in vessel traffic through the Suez Canal have persisted into the new year. That is, traffic has decreased by 19.23% between February 2024 and October 2023. In contrast, traffic through the Cape of Good Hope has surged by 7.3% during the same period, indicating a growing preference for this alternative route. Pole Star Global continues to monitor traffic in this region (see image below). Note in the image, the coloured arrows reflect over 50 different ship types, from General Cargo Ships to Bulk Carriers and Crude Oil Tankers. Yellow dots represent stopped, anchored, and moored ships.

Vessel movement within the Suez Canal and the Red Sea region. Image obtained from Pole Star Global’s Maritime Domain Awareness (MDA) platform.

Are There Viable Alternative Routes for Sustainable Maritime Trade?

Disruptions within the Suez Canal come at a time when another maritime choke point is also facing significant disruptions. The Panama Canal, which serves as a vital link between the Atlantic and Pacific Oceans, is grappling with an intense drought. As water levels in the canal plummet, shipping capacity is severely constrained.

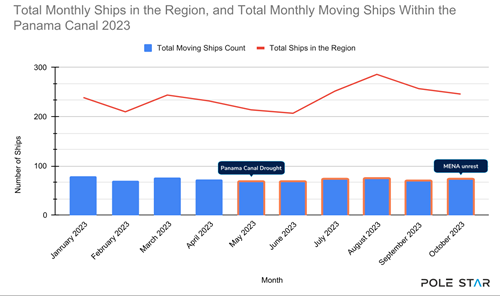

As illustrated in the graph below, since the onset of the drought in May, there’s been a noticeable decline in the total number of ships traversing the Panama Canal. This trend is accompanied by a spike in the number of ships within the region, reflecting constrained throughput and reduced movement out of the area. In response, shipping giant Maersk has already redirected cargo to the railway line running parallel to the canal, as an example. Yet, what connection do disruptions in the Panama Canal have with those in the Suez Canal?

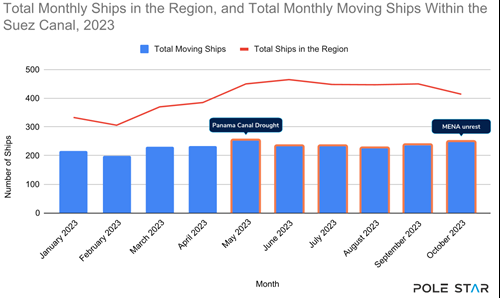

Following the drought within the Panama Canal, some vessels opted for a ten-day detour via the Suez Canal on their voyages between Asia and the US East Coast. Hence, as congestion in the Panama Canal grows, the significance of the Suez Canal for global trade is likewise amplified. This is evident in the data (see below), which indicates an increase in the total number of ships moving through the Suez Canal and the total number of ships in the region since the Panama Canal drought.

In summary, these two critical choke points are interdependent, where reduced throughput in one leads to heightened activity in the other. However, with both canals confronting their unique challenges, multiple pressures are being exerted on international trade. In the case of the Suez Canal, the Panama Canal currently does not offer a viable alternative.

Other potential detour options, such as the Northern Sea Route, also present their own set of obstacles. While this route offers a 40% shorter pathway between Asia and Europe compared to the Suez Canal, its navigability is restricted to just five months a year due to ice, plus there are concerns about its environmental impact on the fragile Arctic ecosystem.

In conclusion, for those seeking to circumvent the Red Sea, the only viable option left is the lengthy detour around Africa, with transits on that route up 168% for the year.

Could Conflict Within the Middle East Increase Shipping Costs and in Turn Global Inflation Rates?

While the immediate focus has been on the surge in energy prices (see above), other industries are feeling the pinch too as the overall cost of shipping rises.

The Shanghai Containerized Freight Index (SCFI) is a key benchmark used to track and analyse changes in freight rates for shipping containers from Shanghai, China, to various global destinations. Considering this index, rates remain lower than those seen during the COVID pandemic, but have risen as a result of the Red Sea Crisis.

Yet shipping costs encompass more than just the initial freight charges; they also include any expenses incurred from shipment delays. Delays will drive up consumer prices as goods take longer to reach their destination. These costs wield significant influence over inflation rates. For instance, amidst the COVID-19 pandemic, disruptions in global supply chains were estimated to have contributed an additional 1% to inflation.

“It’s bad news because it reaches us at a moment when we already have some other trends that have a negative impact on shipping costs. The latest container shipping rates are still low compared to the supply chain crisis during COVID. But they are higher now than they were at any other moment in 2023.” – Jan Hoffmann, head of the Trade Logistics Branch at the United Nations Conference on Trade and Development (UNCTAD)

The convergence of increased freight rates and shipment delays is estimated to fuel an uptick in global inflation rates. While shipping rates have tapered off from their zeniths along certain routes, they persist at elevated levels, with cost escalations permeating various sectors. Initial forecasts project a 0.5 percentage point increment in inflation spread across two years. Yet, a spectrum of potential outcomes, spanning from more conservative to more aggressive estimates, is acknowledged. In a scenario exacerbated by escalating tensions in the Red Sea, the inflationary impact could surge to as much as 1.8 percentage points.

While higher inventories and resilient supply chains might counteract the effects of increasing inflation, there’s also the possibility that a surge in consumer spending and specific European market dynamics could intensify the impact. Yet, it’s evident that businesses have bolstered their preparedness for such disruptions following events like the 2021 Suez Canal blockage and the 2020 global pandemic. For example, companies appear to have achieved a more harmonious equilibrium between inventory levels and consumer demand.

“Businesses look to be in far better shape to weather any potential supply disruption today without having to resort to immediately lifting prices.” – Wells Fargo Chief Economist Jay H. Bryson

How to Manage Contractual Challenges of the “Red Sea Crisis” for Maritime Security

Key stakeholders must understand how the conflict within the Middle East and the attacks within the Red Sea impact contractual matters. The following highlights key developments.

Rights of the Carrier: Understanding Contractual Clauses

- According to the Hague/Hague-Visby Rules, carriers are permitted to divert from the agreed route to save lives or property at sea.

- The charterparty may contain a liberty clause, allowing the carrier to deviate from the planned voyage and transfer containerized goods to another vessel or port.

- Reviewing the charterparty terms is essential to ascertain if deviation is permitted and to what extent.

- Generally, a carrier must make a reasonable deviation to avoid liability for resulting losses.

- In the context of the Red Sea attacks, the carrier must demonstrate that the deviation was necessary for the safety of the vessel or cargo.

- Despite the charterparty permitting route changes, Bills of Lading issued by the carrier may not automatically allow these alterations. Therefore, it’s crucial to carefully examine the documents.

Force Majeure (FM)/Frustration Provisions

- Several international carriers have invoked force majeure (FM) provisions due to the increased danger in the Red Sea region caused by the attacks, leading to a discouragement of using the Red Sea route.

- FM provisions enable parties to be relieved from their contractual obligations in the event of unforeseen circumstances beyond their control. As a result, many voyages along the Suez Canal/Red Sea route are either being terminated or rerouted via the Cape of Good Hope.

- In English law, the legal equivalent of force majeure is frustration, which arises when an unforeseen event disrupts the ability to fulfil a contract after its formation. To claim frustration, a party must demonstrate that the Red Sea situation has made further performance impossible, illegal, or substantially different from what was originally envisioned.

- The interpretation and impact of these clauses depend on the governing law of the contract. Despite the circumstances, contracts can still be executed due to the availability of the alternative Cape of Good Hope route.

Ensuring Port Safety

- The charterparty might include a safe port warranty, requiring the charterer to select a port with both physical and political stability. However, there’s an exception for ‘abnormal occurrences.’ Given the foreseeable nature of the Red Sea attacks, they may not be considered abnormal occurrences.

- If a time charterer chooses an unsafe port, the owner can reject it. If the port becomes unsafe after nomination, the time charterer can select a new safe port.

- A voyage charterer typically needs the owner’s consent to change the route. The charterparty usually specifies that the vessel must proceed to the nominated port or as close to it as safely possible.

- Despite the Red Sea attacks, a safe route via the Cape of Good Hope is available, allowing the avoidance of unsafe ports.

War Risks

- A typical charterparty includes a provision allowing for cancellation or termination in the event of a war.

- Clauses addressing ‘hostilities’ or ‘warlike operations’ may cover the Red Sea attacks.

- The Master must use reasonable judgement to determine if the vessel, cargo, and crew are likely to face war risks.

- Some charterparties may not permit the owner to refuse orders if war risk insurance is available. War risk clauses can also impact the application of the safe port provision, and hire charges may continue during delays caused by war risks.

- If the war risks clause is invoked and the cargo is discharged at a different port, the owner may be entitled to additional freight according to the charter terms. Some war risks include costs for detention or diversion.

- If charterers navigate the ship through a high-risk war zone, standard insurance coverage might be insufficient, necessitating additional insurance with extra fees. While owners typically pay standard insurance fees, the responsibility for additional insurance costs depends on the charter agreement.

The Red Sea as a High-Risk Area

- On December 18, 2023, the Joint War Committee (JWC) expanded its Listed Areas, designating a larger portion of the Red Sea as high-risk. Ships sailing through these areas must inform their insurers and pay higher insurance premiums.

- Concerns may arise regarding the safety of ports within these high-risk areas, their inclusion in the charterparty’s trading limits, and the possibility of ship owners opting for an alternative port.

- If the parties in the charterparty decide to deliver the cargo at a different port, they should verify if the bill of lading specifies a particular unloading port.

- Delivering to an alternative port without the bill of lading permitting it may constitute a breach of the contract.

Activate Essential Watchlists Within Pole Star Global for Compliance and Safety

Amidst recent developments involving Iran’s involvement in the Middle East conflict, tensions are mounting, amplifying the impact on the energy sector, maritime trade, and global shipping costs plus inflation. Navigating this intricate landscape necessitates a deep understanding of how these developments affect contractual obligations and the global sanction framework.

At Pole Star Global, we recognize the multifaceted challenges posed by the conflict within the Middle East. Our dedicated team stands ready to provide both support and tailored solutions to address your concerns.

In light of Iran’s recent actions against Israel, it’s increasingly probable that the U.S. will impose additional sanctions targeting Iranian oil networks and vessels linked to the IRGC. In this evolving scenario, remaining informed and compliant is imperative. With Pole Star Global’s PurpleTRAC solution, you can activate essential watchlists to proactively manage risks, ensuring the safety and resilience of your business.

Stay informed, stay secure, and trust that the Pole Star Global team is committed to delivering steadfast support at every juncture. Get in touch to speak to a member of our team today, and learn how you can ensure maritime security during these turbulent times.