- Green shipping corridors are zero-emission routes linking two or more ports.

- These routes rely on the implementation of zero-emission fuels for ship propulsion.

- By design, green corridors showcase sustainable fuels and optimised shipping paths in practice.

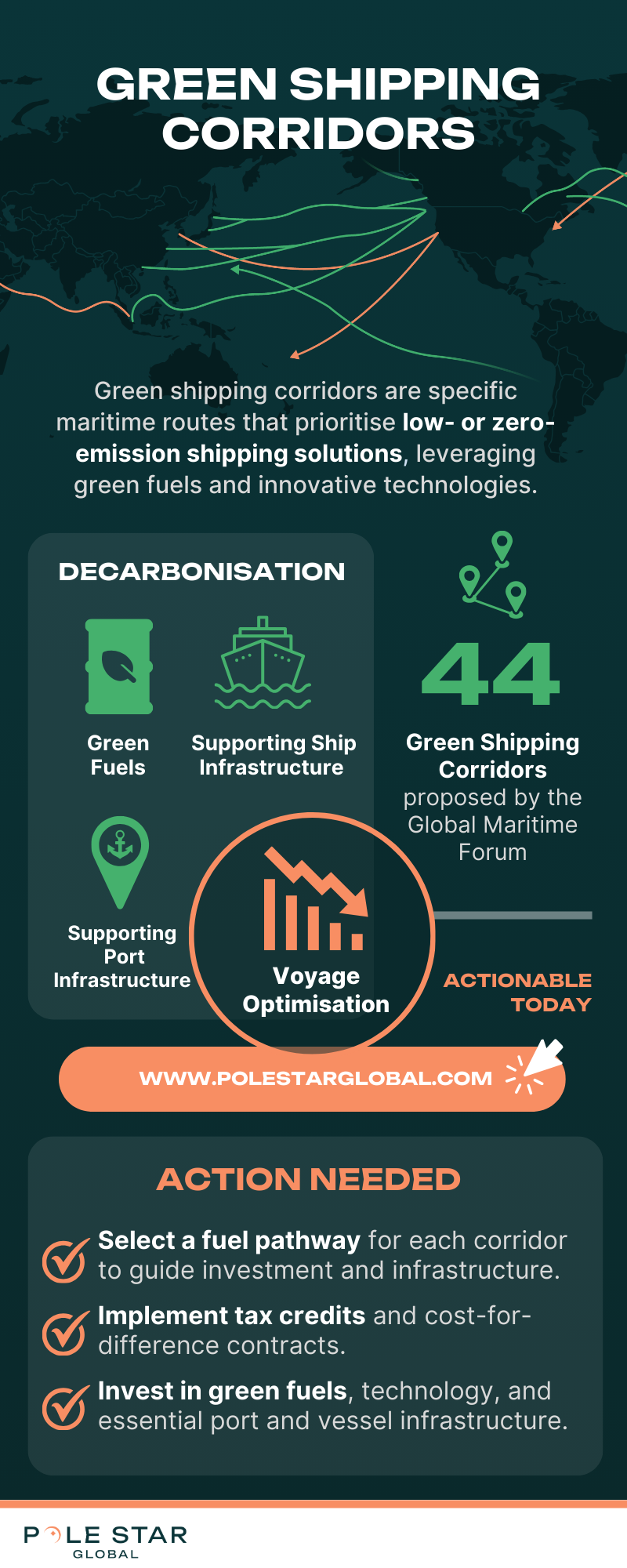

What are green shippping corridors? Green shipping corridors are specific maritime routes between ports where zero- or near-zero-emission shipping solutions are deployed. Government and businesses support these routes through coordinated action.

The COP26: Clydebank Declaration rallies for the creation of green shipping corridors. The goal is to establish at least six green corridors on major deep-sea routes by 2026. Plus, stakeholders have put a road map in place for three to four more routes, and continue to develop a further two to three.

In line with these goals, Pole Star Global assesses the feasibility of green shipping corridors.

Knowledge Check

Check the box when you feel confident in your understanding of each question to track what you’ve learned from this article

Is the maritime industry on track to meet net-zero targets?

Will green corridors transform the maritime industry toward net-zero emissions?

Is the implementation of green shipping corridors feasible?

Do green shipping corridors lack tangible action? Are they prone to greenwashing?

In answering these questions, you’ll learn how the green shipping corridor movement has progressed. Gain insights into the fuel, port, and vessel requirements that bolster green shipping initiatives, for a more sustainable industry and global supply chains.

- What Is Net Zero?

- What Are Green Shipping Corridors?

- What are the Benefits of Green Shipping Corridors?

- Is the Maritime Industry on Track to Meet Net-Zero Targets?

- Is the Implementation of Green Shipping Corridors Feasible?

- Fuels: Alternative Green Fuels Are a Necessity for Green Shipping Corridors

- Ports: Port Infrastructure Is Essential to Lower Shipping Emissions

- Ships: Green Shipping Corridors Must Upgrade Vessels to Operate Using Low-Carbon Fuels

- Voyage Optimisation: Green Shipping Corridors Aim to Cut Energy With Optimal Shipping Paths

- Do Green Shipping Corridors Lack Tangible Action? Are They Prone to Greenwashing?

- Is Shipping Prepared to Realise the Full Potential of Green Corridors?

Green Shipping Corridors Analysis: Key Insights and Statistics

Article Summary: This article examines the role of green shipping corridors in decarbonising the maritime industry to achieve net-zero greenhouse gas emissions by 2050, in line with IMO and Paris Agreement targets. Shipping currently contributes around 2.9% of global emissions, which have increased over the past decade, making decarbonisation urgent.

Green shipping corridors are designated maritime routes that prioritise low- or zero-emission fuels, energy-efficient technologies, and collaborative stakeholder engagement across ports, shipowners, fuel providers, regulators, and cargo owners. They serve as testing grounds for innovative fuels such as green ammonia, methanol, hydrogen, and biofuels, alongside voyage optimisation, vessel upgrades, and port infrastructure improvements.

The International Maritime Organization (IMO) set an ambitious target to achieve net-zero emissions by 2050. To meet this aim, a radical transformation of the maritime industry is needed. For this reason, green shipping corridors offer a promising solution. This is because they’re capable of mobilising key stakeholders and the necessary investments and infrastructure.

Yet, formidable challenges persist that could obstruct progress. These challenges include:

- Uncertainty surrounding the choice of fuel pathways.

- Navigating a complex stakeholder landscape.

- High investment costs to support the green transition.

- Identifying priority shipping segments for intervention.

Addressing these challenges demands collaboration and transparency among key stakeholders. Plus, green technologies and AI-driven software solutions are crucial in facilitating a smooth transition to net zero emissions.

Despite these hurdles, green corridors are positioned as a strategic mechanism for achieving emissions reductions, improving fuel efficiency, fostering collaboration, and transforming the shipping sector towards a net-zero future.

Key Green Shipping Corridor Statistics

- Shipping accounts for 2.9% of global GHG emissions (2018); emissions rose 20% in the last decade.

- COP26 Goal: 6 green corridors by 2026, with 3–4 more planned and 2–3 in development.

- Global Maritime Forum (2023): 44 green corridors proposed.

Fuel Mix by 2050 (IEA Projection):

- 50% e-ammonia

- 20% e-hydrogen

- 20% biofuels

- 10% e-methanol

Current Fuel Pathway Adoption:

- 41% undecided

- 16% methanol, 16% ammonia, 9% hydrogen, 9% biofuels, 9% electricity

Fuel Cost Estimates (2030):

- E-methanol: $35 per GJ | Conversion Cost: $30B

- E-ammonia: $35 per GJ | Conversion Cost: $75B

Port Infrastructure Milestones:

- 2025: First hydrogen bunkering at Port of Amsterdam

- 2023: First methanol bunkering at Port of Rotterdam

- 2022: First ammonia bunkering network in Scandinavia

Vessel Readiness:

- 936 LNG-capable vessels

- 190 methanol-fueled vessels

- 230 ammonia-ready vessels

- 46 wind-assisted vessels

- 1,533 cold iron-capable vessels

Current Adoption & Support:

- Only 0.6% of global fleet uses alternative fuels

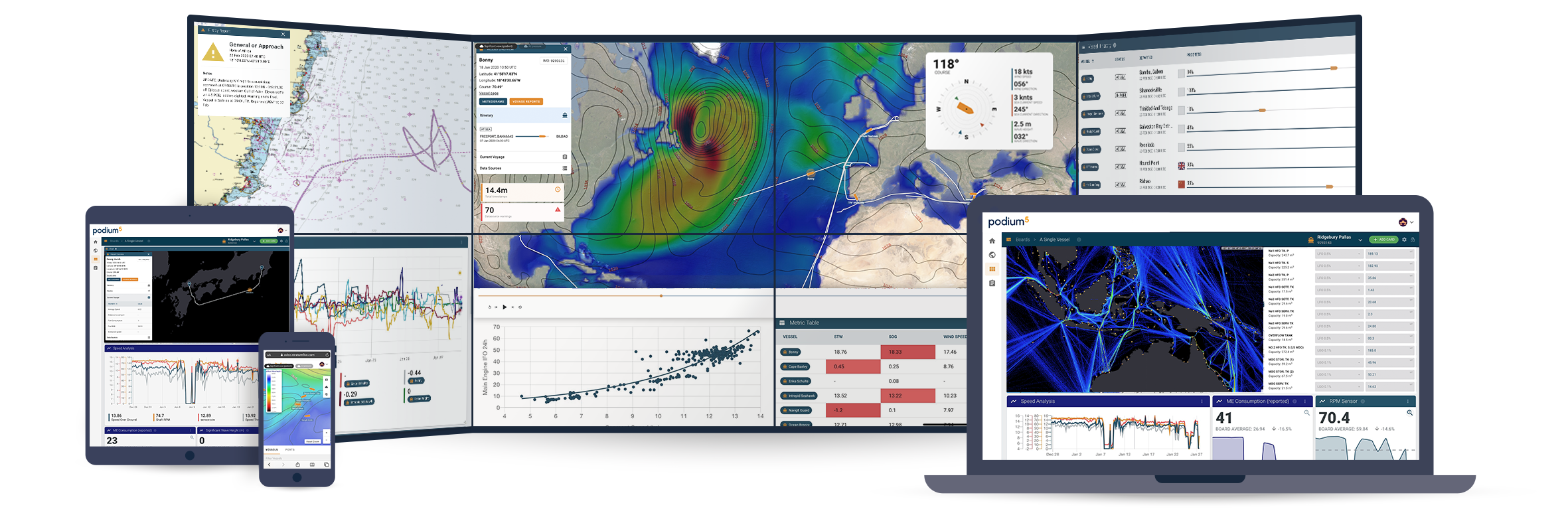

- AI platforms (e.g., Podium5) assist with voyage optimisation

- Requires policy support: subsidies, cost-for-difference contracts, tax credits

- Risks of greenwashing due to unclear definitions and low barriers to entry

What Is Net Zero?

Achieving net zero is a balancing act. That is, the volume of greenhouse gas (GHG) emissions released into the atmosphere by a given entity must match the volume of GHG emissions removed from the atmosphere by that entity. This ensures total emissions are equal to zero.

The aim of net zero is to mitigate the impact of climate change by limiting global temperature rise to 1.5°C.

This follows the guidance provided by the IPCC and the Paris Agreement. Considering that the shipping sector accounts for approximately 2.9% of global emissions, addressing the challenges of climate change demands the decarbonisation of this particular industry.

Unfortunately, emissions from shipping have surged by 20% in the past decade. This hinders the emission reduction goals of dependent stakeholders across supply chains, with 80% of global trade dependent on shipping logistics.

In response to these challenges, green shipping corridors have been strategically planned to expedite the journey toward net zero for shipping on a global scale.

Carbon neutral shipping is another term you will have come across. To learn more about carbon neutral shipping and how it relates to net zero, please refer to the following article: Carbon Neutral Shipping: Drive Results With The 4-C Approach.

What Are Green Shipping Corridors?

Green shipping corridors are specific maritime routes that prioritise low- or zero-emission shipping solutions, leveraging clean energy, sustainable fuels and innovative technologies to reduce carbon footprints and support global decarbonisation efforts in the shipping industry.

Achieving IMO’s net zero goals and country-specific targets demands a collaborative approach. Decisions must involve multiple stakeholders, from government entities, port authorities, and ship owners. And decisions are to be made across four key focus areas: Fuel, ports, ships, and voyage optimisation.

Green shipping corridors cut through this complexity by offering ideal settings for new strategic regulations, partnerships, and fresh business ideas. It’s within these corridors that stakeholders document and report zero-emission shipping solutions.

The Global Maritime Forum’s last annual report released in December 2023 proposed 44 green shipping corridors. This includes both short-sea and deep-sea routes.

Green Shipping Corridor Map

What are the Benefits of Green Shipping Corridors?

Green shipping corridors are emerging as a key strategy in the maritime industry’s transition towards decarbonisation. These designated trade routes, supported by clean fuel infrastructure and policy alignment, offer a range of environmental, economic, and operational advantages.

- Reduced Greenhouse Gas Emissions

By integrating alternative fuels such as ammonia, hydrogen or biofuels, green shipping corridors significantly cut carbon dioxide and other harmful emissions. This contributes to global climate goals and enhances the environmental performance of shipping fleets. - Improved Fuel Efficiency

Optimised routing, speed reduction and the adoption of energy-efficient technologies within these corridors lead to better fuel utilisation. This not only lowers operational costs but also extends vessel lifespan. - Regulatory Compliance

Operating within green corridors helps shipping companies meet stringent international regulations, such as the IMO’s 2030 and 2050 emissions targets, and EU ETS. Early adoption positions companies ahead of future policy changes. - Enhanced Industry Collaboration

Green corridors promote cross-sector partnerships between ports, shipowners, fuel suppliers and governments. These collaborations foster innovation and help scale sustainable practices across the maritime supply chain. - Brand Reputation and Market Advantage

Demonstrating commitment to sustainability through participation in green shipping initiatives boosts brand credibility, attracts environmentally conscious customers, and opens doors to green financing opportunities.

Is the Maritime Industry on Track to Meet Net-Zero Targets?

By 2050 Target the Target is to Have:

- 20 ports across three continents supplying zero-emission fuels.

- Zero-emission fuels to power at least 200 vessels on major deep-sea routes.

Determining green shipping corridors demands a comprehensive evaluation that includes the following (as mentioned earlier): Fuels, ports, ships, and voyage optimisation. Each of these areas is elaborated on later in this article.

There’s Global Pressure for Net-Zero Shipping

The International Maritime Organization (IMO) mandates a 50% emission reduction for all vessels by 2050. This target aligns shipping with the long-term temperature goal set by the Paris Agreement: to limit global temperature rise to 1.5°C above pre-industrial levels.

In response, several countries have committed to net-zero shipping emissions by 2050—among them: Japan, the United States, the United Kingdom, and countries within the European Union.

EU’s Key Measures:

- EU Emissions Trading System (ETS) – A cap-and-trade scheme launched in Jan 2024 to regulate emissions geographically.

- EU-MRV System – Enables carbon emissions tracking aligned with EU Regulation 2015/757.

Meanwhile, the UK MRV regime compels operators to collect and report emissions data similarly.

Where Are Green Corridors Today in Terms of Net Zero?

In 2018, the shipping industry emitted approximately 2.9% of global emissions, which has the potential to rise to 130% of 2008 levels by 2050. This trajectory indicates the industry is not on track for net-zero targets.

The IMO’s revised targets align with the Paris Agreement, yet stakeholders must take new steps to achieve a Net Zero Emissions by 2050 (NZE) Scenario, calling for a 15% emissions cut between 2020 and 2030.

While the maritime sector doesn’t align with net-zero targets today, there’s still potential to reach net zero by 2050.

Technological advances in green fuels, enabling policies, and cross-sector collaboration will be crucial. Green shipping corridors are emerging as the building blocks for this transformation.

Will Green Corridors Transform the Maritime Industry?

To meet 2030 goals, an estimated 5% of all maritime fuels must be scalable zero-emission fuels. Green corridors offer real-world labs for experimentation, deployment, and cost-reduction—setting the stage for mass decarbonization by 2030 and beyond.

Examples of Green Shipping Corridros

| Green Shipping Corridor | Details |

|---|---|

| Australia-Japan Iron Ore Route | With a clear stakeholder landscape and strong political cooperation, this route stands out as a promising green shipping corridor. 90% of the Australian ore exported to Japan comes from companies dedicated to achieving net-zero emissions. The most promising fuel pathway for this route is zero-emission ammonia. Wärtsilä introduced the first-ever 4-stroke ammonia engine in November 2023, reducing emissions by |

| Northeast Asia–US Car Carrier Route | Shipping companies and cargo owners along this route are keen to shift to net zero. However, vessel rerouting to alternative markets poses a challenge.

The corridor will likely use green ammonia as a |

| Portugal–Brazil Route | Green hydrogen is the preferred alternative fuel. The corridor aims to ensure vessel access to green fuels at various ports along the route. |

| Shanghai–Long Beach Route | The Ports of Los Angeles, Long Beach, and Shanghai, with global partners, developed an Implementation Plan Outline for this busy container route.

Read more: The Transpacific Green Corridor: A Prefeasibility Assessment |

Is the Implementation of Green Shipping Corridors Feasible?

The feasibility of any given green shipping corridor can be assessed under four key focus areas: Ports, fuels, ships and voyage optimisation.

Fuels: Alternative Green Fuels Are a Necessity for Green Shipping Corridors

At their core, green shipping corridors replace crude oil with zero-emission alternatives. As mentioned, an estimated 5% of fuels will have to be scalable zero-emission fuels by 2030 to achieve 2050 targets. This demands investments into electric motor engines powered by renewable energy, and methanol, ammonia, and hydrogen-based fuels. These green alternative fuel pathways need new infrastructure at ports and on ships. For instance, to set up appropriate fuel plants and to service zero-emission boats.

The transition to alternative fuels is already underway. Major container shipping lines, such as Maersk, Evergreen, CMA CGM, and COSCO, are already placing orders for vessels capable of burning both methanol and methane. For example, Maersk reported the successful voyage of its first dual-fuel vessel in August 2023. The vessel, loaded with cargo, sailed from South Korea to Denmark using a combination of green methanol and fuel oil.

In another example, ports in Rotterdam and Singapore house storage facilities for green fuels such as ammonia and methanol. And in September 2023, the first methanol-powered container ship, Laura Maersk, sailed between these two countries. This ship delivered up to a 65% GHG emission reduction compared to fossil-fuel-dependent engines.

Meanwhile, the cargo firm North Sea Container Line is launching a ship powered by ammonia to operate between Norway and Germany.

Current Challenges: Undecided Fuel Pathways

Despite this progress, challenges remain that could impede further advancement. One crucial obstacle to address is the uncertainty over the fuel pathway of choice.

So far, eight corridors have decided on one or several fuel pathways. That is:

- 16% of initiatives focus on green methanol,

- 16% of initiatives focus on green ammonia,

- 9% of initiatives focus on advanced biofuel,

- 9% of initiatives focus on green hydrogen,

- A further 9% of initiatives focus on green electricity.

However, for most initiatives (41%), the fuel pathway is yet to be determined. In these instances, it seems key decision-makers are trying to maintain flexibility for as long as possible. This indecisiveness is compounded by the insufficient involvement of fuel providers. This is a symptom of a complex stakeholder environment. (Another key challenge that’s looked at below.)

When choosing the appropriate fuel pathway, there are two possible strategies:

- Multi-Fuel Pathway: The multi-fuel strategy is a more prudent approach, hedging risks that come from an over-reliance on a single technology. This risk is more prominent for larger routes.

- Single-Fuel Pathway: A single-fuel pathway gives more concentrated efforts and faster progress. However, the downside is that it puts all investment efforts in one basket.

The debate remains about which fuel strategy is the best approach. This decision must be made on a case-by-case basis, performing a thorough cost-benefit analysis for each fuel option. Yet, such analyses often result in ambiguous outcomes due to several unknowns – as with any new technology.

To illustrate, consider the below comparison of green ammonia and green methanol.

Comparing Green Ammonia and Green Methanol

In the past year, green methanol has taken the lead over ammonia in shipping. Major players like Maersk have placed large orders for dual-engine vessels running on methanol. However, there are cost concerns over implementing this technology on a global scale, as noted by the International Energy Agency (IEA). These costs stem from CO2 capture and supply to ensure the methanol used is green.

As such, the IEA recommends well-planned facilities in areas that have abundant renewable resources and affordable biogenic CO2 options. (Biogenic CO2 is derived from living organisms rather than the burning of fossil fuels.) This will create low-emission e-methanol for $47 per gigajoule (GJ). The IEA predicts these costs will drop to $35 per GJ by 2030.

You must note that these estimates assume optimal production. If the supply of e-methanol is less than optimal, the total cost of ownership for methanol-fueled ships could be triple that of conventional vessels.

In contrast, e-ammonia would be cheaper than even the most efficiently produced e-methanol. Specifically, e-ammonia is estimated to cost $40 per GJ (dropping to $35 per GJ by 2030).

However, adding to the complexity of this discussion, initial investments supporting e-ammonia are higher. Employing safety measures that manage ammonia’s potential toxicity is costly. As such, the IEA estimates a transition cost of $75 billion to convert half of all containerships to fleets relying on ammonia. Now, compare this to the $30 billion needed for e-methanol ship conversion.

In Summary

In summary, the shipping infrastructure required to support e-ammonia is higher than that of e-methanol. But, once that infrastructure is in place, the production costs of e-methanol fuels are greater.

This example demonstrates the challenge of selecting the appropriate fuel pathway based on a comprehensive cost-benefit analysis.

With further analyses of this nature, the IEA reports that by 2050, the collective fuel pathway across green corridors will be as follows:

- 50% e-ammonia fuels,

- 20% e-hydrogen fuels,

- 20% biofuels,

- and then methanol fuels will supply the marginal quantity by 2050.

Current Challenge: Cost of the Green Shipping Transition

The latter point leads nicely onto a second challenge of green fuel transition. The cost of green shipping.

Some sceptics question the widespread adoption of green shipping corridors. They argue that the necessary changes come with a large price tag to construct new infrastructure and upgrade fleets. Not to mention the increased expense of alternative green fuels compared to their fossil fuel counterparts.

These investments are factored into the Total Cost of Ownership (TCO) for each vessel. The TCO is a crucial element when determining the viability of routes and fuels within a green shipping corridor. Introducing zero-emission fuels will raise operational costs initially. This means it’s imperative to share the burden and risk across the green corridor. The aim is to bridge the TCO gap between fossil-fuel-powered vessels vs those powered by green fuels.

Government intervention is essential here, to mitigate investment risks for fuel producers and vessel/fleet operators. Initiatives could include:

- Implementing contracts based on cost-for-difference,

- Providing tax incentives and direct subsidies.

The above initiatives will create a competitive landscape that facilitates the adoption of green shipping corridors.

Ports: Port Infrastructure Is Essential to Lower Shipping Emissions

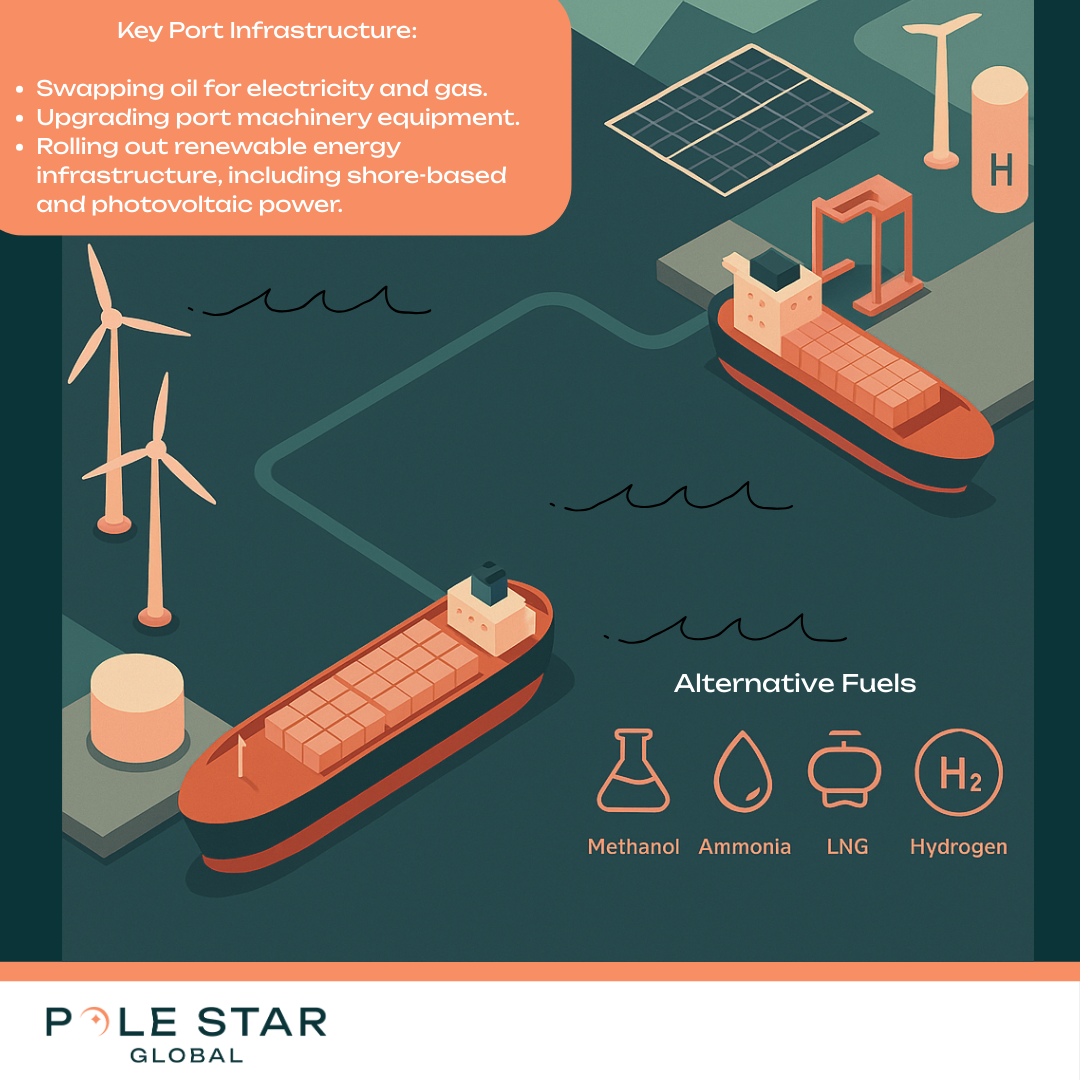

Ports within green shipping corridors need the required infrastructure to facilitate the green fuel transition. This means supporting green fuel storage and bunkering (truck-to-ship, and ship-to-ship), and/or charging facilities.

Technological progress has enabled the successful bunkering of green fuels. Notably, in September 2023 the Port of Rotterdam marked the first successful bunkering of green methanol-powered container vessels. Plus, in 2022, Scandinavia introduced the world’s first carbon-free ammonia fuel bunker network. Similar advancements are emerging globally. For instance, countries like Japan are developing a bunkering boom for the ship-to-ship transfer of ammonia fuel.

Current Challenges: High Stakeholder Complexity

Key stakeholders for any given port along a green corridor include:

- Port authorities,

- Vessel owners and operators,

- Government and regulators,

- Fuel producers,

- Customer/cargo owners,

- Financial institutions.;

Involving all stakeholders – who are likely dispersed across vast geographical areas – is crucial. Successful involvement depends on trust and decision-making processes with clear goals.

As they progress, green shipping corridors will extend to involve a broader range of non-shipping entities. Examples include fuel producers, cargo owners, and research and development teams. And so the magnitude of this challenge will escalate. Additionally, when competitors use the same corridor, it hinders the sharing of information. If not addressed, this could cause a potential bottleneck.

To meet this challenge head-on, group efforts must be effectively led using the right management systems. However, this continues to be a tough obstacle in the ongoing creation of green corridors.

Ships: Green Shipping Corridors Must Upgrade Vessels to Operate Using Low-Carbon Fuels

Ships must have the right infrastructure in place to operate using green fuels. This includes zero-emission fuel tanks and suitable energy converters. Currently, vessels can be upgraded to support the following green technologies:

- E-hydrogen fuels,

- E-ammonia fuels,

- Liquified Natural Gas (LNG),

- E-methanol (biofuel),

- Wind-assisted technology,

- Cold iron connectivity.

*Cold iron: Supplying electrical power to a ship while it’s docked, with both its main and auxiliary engines turned off. This is also known as shoreside electrical power provision at berth.

At present, only 0.6% of global ships operate on alternative fuels. Yet, as attention to, and investments in sustainable practices rise, this percentage is on the rise. For instance, Amazon, in collaboration with companies like Patagonia and Ikea, has extended its emission reduction contract with shipping giant Maersk, as part of the Zero-Emissions Maritime Buyers Alliance (ZEMBA).

And this momentum for green fuels is seen on a global scale, across industries. Notably, China aims to produce over half of the world’s green ships by 2025. Featured vessels include those powered by liquified natural gas (LNG) and e-methanol.

Increasing Vessel Efficiency

There’s also been a focus on vessel enhancement for increased efficiency and reduced energy consumption. A noteworthy example is the successful test voyage of the Pyxis Ocean in August 2023. This ship uses wind-assisted technology to reduce fuel consumption, which has given fuel savings of up to 30%.

Additionally, in December 2022, Stolt Tankers ordered a fleet of six stainless steel parcel tankers designed for optimal fuel efficiency. Features include hull optimisation, shore power connection, and future-ready adaptations for battery and methanol propulsion. Plus, the company has pioneered a new green technology to reduce fuel consumption. This is an eco-friendly coating to be applied to the hull of one of its chemical tankers.

Exploring promising technologies such as Lithium Ion batteries also remains a key focus, with notable advancements in this field.

Current Challenge: Indecision on Which Vessels to Target

Pole Star Global has collected global data to assess the current landscape of zero-emission vessels. These unique insights are given below:

- LNG capabilities:

- Currently, 936 vessels in service are LNG capable (have dual fuel vessels).

- 413 vessels are LNG-ready – this means they can be converted more easily.

- E-methanol-fueled:

- There are 190 methanol-fueled vessels. 128 of these are container vessels, with one currently in service.

- There are 107 methanol-powered container vessels on order.

- There are 168 methanol-ready vessels, 79 of which are container ships. 26 methanol-ready ships are in service, 104 are on order, and 13 are under construction.

- E-ammonia Fueled:

- 9 ammonia-powered vessels are on order (7 from EPS and 2 from Exmar).

- 230 vessels are ammonia-ready, with 58 in service and 123 on order. 66 of both categories are container vessels

- E-hydrogen Fueled:

- There are 17 hydrogen-fueled vessels operational along this corridor, with 8 in service. 32 ships are hydrogen ready, 14 of which are in service. Out of these, only 2 are container vessels, with most being passenger vessels and crew/supply vessels.

- Wind Assisted:

- There are 46 total wind-assisted vessels, 34 in service and 4 on order. None of these ships are container vessels.

- Vessels that can cold iron*:

- There are 1533 vessels (958 container vessels) operating along this route that are cold iron capable.

Currently, most green shipping corridor projects concentrate on the largest shipping segments – container shipping and ferries. Even though there are attempts to start similar projects for dry bulk, tanker, and cruise ships, decisions on which shipping areas to prioritize for ten corridors are still pending. This choice will impact initial efforts and the creation of plans to gradually include more segments in the future. These decisions play a critical role in achieving 2050 targets.

Voyage Optimisation: Green Shipping Corridors Aim to Cut Energy With Optimal Shipping Paths

Voyage optimisation ensures vessels navigate to their destination more efficiently. While this practice is crucial for reducing fuel consumption, note that this process alone will not yield net zero. Yet, used alongside alternative green fuels, voyage optimisation facilitates a smooth net zero transition by decreasing fuel consumption from the start.

Key voyage optimisation techniques include:

- Just-In-Time Arrival: Ship speed is adjusted to avoid delays during port entry. This, in turn, minimises greenhouse gas emissions. Ships often spend up to 9% of their time waiting to enter a port. Just-in-time arrival techniques can yield fuel reductions of up to 23% for the entire voyage and port call.

- Port Call Optimisation: Ship speed is refined to improve overall port efficiency. This means cargo owners can deliver their goods reliably and according to schedule.

- Weather Routing: Environmental factors like tides, winds, and currents are incorporated into the planned ship routes to enhance voyage efficiency.

- Dynamic Under-Keel Clearance: Routes are planned to ensure vessels maintain sufficient under-keel clearance for a safe journey, considering environmental conditions during the voyage. This clearance guarantees an adequate water depth beneath the ship for a secure transit.

Implement the above voyage optimisation techniques with Pole Star Global’s Podium5. Podium5’s cutting-edge platform provides weather routing and route optimisation services. Utilise Podium5’s smart automation and expert advice and be empowered to make informed decisions to reduce fuel use.

Powered by an advanced AI-based voyage optimisation algorithm, Podium5 excels at enhancing shipping time and TCE (Time Charter Equivalent), all while minimising fuel consumption and emissions. The platform revolutionises planning processes and ensures precise Estimated Time of Arrivals (ETAs) for every journey.

Summary: Is the Implementation of Green Shipping Corridors Feasible?

Voyage optimisation techniques, advancements in ship design, and innovations in fuel efficiency are already showing promising progress to establish green shipping corridors. Yet, implementing these initiatives in isolation does not secure a widespread, global transformation. For this, coordinated efforts across various industries and stakeholders are needed. These collaborative efforts must:

- Decide on a fuel pathway for each corridor, to focus efforts, infrastructure, and investment.

- Instill the required tax credits and contracts based on cost-for-difference.

- Continue to invest in green fuels and supporting technology. Notably, the needed port and vessel infrastructure to support green fuels.

Without addressing the above, green shipping corridors will remain an unrealized concept.

Do Green Shipping Corridors Lack Tangible Action? Are They Prone to Greenwashing?

Greenwashing is the exaggeration of a given entity’s sustainability claims. This creates the impression that an entity’s environmental impact is smaller than it is in reality.

Regarding green corridors, the absence of a universally recognised and standardised definition raises concerns about greenwashing. This lack of clarity around the concept can cause confusion on how to effectively support and regulate these routes.

These greenwashing concerns could undermine the full potential of these corridors. As such, it’s important to acknowledge the risk factors that could cause greenwashing in the green corridor movement. Three key risk factors are identified and addressed below:

- Low barriers to entry: The absence of stringent criteria allows anyone to declare a shipping corridor as green. This openness leaves room for stakeholders to design corridors without firm commitments.

- Public relations advantages: The announcement of a green corridor attracts significant political attention. There’s a risk actors might exploit this by declaring intent without taking decisive actions. As more corridors are introduced, the public relations benefits for all involved may diminish.

- Competition: The increasing involvement of ports in the green corridor movement creates pressure for others to follow suit to remain competitive. Unfortunately, some may do so without genuine intent to install the necessary changes to achieve carbon-neutral shipping.

Solution: Announcements should be treated as signals of intent only, to be followed by tangible action

To counteract greenwashing within the green corridor movement, transparency plays a crucial role. This involves standard reporting on the progress of green corridors and educating stakeholders. Plus, the sharing of data and challenges will foster an environment where all participants collaborate to address key challenges and to make collective progress.

Is Shipping Prepared to Realise the Full Potential of Green Corridors?

In theory, green shipping corridors offer the requisite conditions for achieving net zero emissions. They are dedicated spaces for testing, innovation, and investment. As such, these corridors hold the potential to revolutionise the maritime industry. From an industry known for its high carbon emissions, green corridors can transform shipping to be a front-runner in the new net-zero economy.

This is an ambitious goal and so challenges are to be expected. The green corridor movement does face obstacles, yet this doesn’t render the concept infeasible. Through collaborative efforts transcending geographical and organisational boundaries, each challenge can be addressed collectively.

Alongside this collaboration, industry stakeholders must ensure the adoption of appropriate technologies, artificial intelligence, and software solutions to facilitate a seamless transition to net zero.